Business Accounting

The basic principles of double-entry book-keeping will be familiar to anyone who has done any work on the financial side of a business, as it is the accounting method used today to record financial transactions and analyse the performance of an organisation.

The double-entry method of accounting was invented in Italy in the early fourteenth century, and first described fully in print by Luca Pacioli in his Summa de Arithmetica, Geometria, Proportione et Proportionalita, printed in Venice in 1494. The system is sometimes called 'the system of Venice' because of its roots there.

The first English book was Hugh Oldcastle's A Profitable Treatyce called the Instrument or Boke to learne to knowe the good order of the kepyng of the famous reconynge called in Latyn, Dare and Habere, and in Englyshe, Debitor and Creditor, published in London in 1543. This book is now lost, but James Peele's The Maner and fourme how to kepe a perfecte reconyng, published in London in 1553, is considered to be the best-written and most clear of early English books on the subject, and illustrated with a complete set of imaginary books of account for a tradesman.

By the late-eighteenth and early-nineteenth centuries, there were many textbooks for young clerks who needed to learn the rudiments of commercial life. Robert Goodacre, master of Standard Hill Academy in Nottingham, wrote A Treatise on Book-Keeping adapted to the use of Schools (Nottingham 1818), and explained double-entry book-keeping as follows:

The art of Book-keeping may be said to be performed by two general methods, viz. SINGLE and DOUBLE ENTRY.

In SINGLE ENTRY, the purchase or sale of any article, or the receipt or payment of any money is entered once, under the name of the person concerned.

In DOUBLE ENTRY, the same article is entered under the name of the person, and also under the head of the article itself. Hence from the circumstance of every article's being twice entered in the Books the method is called Double Entry.

In Book-keeping, by whatever method practised, observe the following

GENERAL RULE.

The person who RECEIVES is Dr. (Debtor) for that which he receives; and the person who PARTS WITH is Cr. (Creditor) for the article which he parts with.

Thus, if I sell goods on credit, the person to whom I sell them is Dr. or indebted to me for the amount of the goods. If I buy goods on credit, the person of whom I buy them is Cr. for the goods; that is, I am indebted to him for their amount. In like manner if I pay a person a sum of money he is Dr. or indebted to me for the money; and if I receive money of him he is Cr. that is, I am indebted to him for its amount.

The abbreviations Dr. and Cr. often appear at the left-hand and right-hand sides of double-entry accounts. Dr. is an abbreviation for Debitor [Latin for debtor], and Cr. is an abbreviation for Creditor. For each transaction there is a debtor and a creditor, and the amounts of money recorded on each side of the account must be the same for the account to be correct.

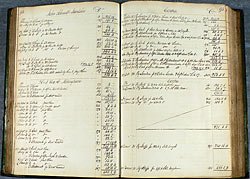

Double-entry ledger from J. and H. Hadden and Company Limited, Hosiers, Nottingham (Ha A 3-5)

View larger version

Day books, ledgers and balance sheets

Series of ledgers from J. and H. Hadden and Company Limited, Hosiers, Nottingham, 1787-1797 (Ha A 3-5)

Double-entry accounting made use of a wide variety of inter-connected books and reports, but a basic system in the nineteenth or early-twentieth centuries would function as follows:

Daily records of transactions were entered into a volume called a journal or a day book, as they occurred. In larger companies where many events took place on the same day, a number of different journals or day books began to be used for the different types of transaction. Sales and purchase day books recorded sales and purchase orders on credit. Cash books recorded the receipt or payment of the actual money, a few days, weeks or sometimes months after the orders were placed. Sometimes clerks used a 'waste book' to make preliminary notes before copying the details neatly into the day book. All of these books are collectively known as books of prime entry.

Details of these transactions were then written into ('posted' in accounting jargon) the principal account books called ledgers, in double-entry form. The information in the ledgers was categorised, allowing people to see at a glance how much business a particular customer had brought, or how much was being spent on supplies.

Ledgers contained the records of each separate account associated with the business. For instance, each new customer had a separate account, and therefore a separate page in the ledger to record each of their transactions. There were also separate accounts for suppliers, and for other accounts such as the business's account with its bank. Each account had two sides - the debit side on the left, and the credit side on the right.

Details of each transaction from the books of prime entry were posted twice - to the credit side of one account, and to the debit side of another account. If only one account was completed, the ledger would not balance.

Some businesses only used one ledger to record all accounts. Larger businesses increasingly used a variety of different ledgers. Ledgers could be classified into two main types:

- Personal ledgers, e.g. Sales Ledger and Purchases Ledger. The accounts in these ledgers were all in the names of particular customers or suppliers.

- Impersonal ledgers, e.g. Real Ledger, Nominal Ledger, Capital Ledger. The accounts in these ledgers were not associated with a particular person, but were more general accounts relating to, for instance, property and assets. Private Ledgers recorded confidential financial information and are often found with large locks.

The amount of detail about individual customers and their orders decreases as the transaction record passes through the system. Cross-references are placed in the books so that the transactions can be tracked backwards and forwards.

Finally, financial reporting would take place at regular intervals with the publication of balance sheets and profit and loss accounts.

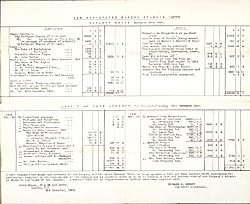

Annual account of The Kingsclere Racing Stables, Ltd., Newbury, Buckinghamshire, 1905 (Pl F10/3/5/3)

View larger version

This example from the Kingsclere Racing Stables Ltd., of Newbury, is an 'English balance sheet', showing the financial position of the company on a particular date - in this case, 30 November 1905. On the left hand side of the balance sheet are Liabilities, which are the company's debts or obligations. This could include original sources of finance such as shares and loans. On the right hand side are Assets, which are resources or money which benefit the business, for example premises or stock. English balance sheets were brought into line with other European balance sheets by the Companies Act of 1981. Balance sheets from after that date are the other way round, with Liabilities on the right and Assets on the left.

The Profit and Loss Account covers the period up to 30 November 1905 - a period which is unspecified but which includes two years salary for the Secretary. On the left hand (debit) side are expenses and payments out; on the right hand (credit) side are receipts. The difference between the two sides amounts either to a profit (where the debits are less than the credits) or a loss (where the debits are more than the credits).

An example of a transaction tracked through a series of account books and ledgers

This example uses the account books of R. and F.E. Lamb Ltd., outfitters, of Bridlesmith Gate, Nottingham.

Measure Book of R. and F.E. Lamb Ltd. (Lb A 6)

View larger version

On folio 85 of the Measure Book (Lb A 6) there is an entry for order number 354, for 6 tennis shirts, placed by Captain J.W. Turner. The date given is April 1929.

The order is written in pencil and consists of a number of detailed measurements for the shirts.

Day Book of R. and F.E. Lamb Ltd. (Lb A 15)

View larger version

There does not appear to be any efficient way of following the details in the Measure Book through to the Day Book (Lb A 15). No cross-references are given. But, by searching through the Day Book entries for April 1929 we eventually find the relevant entry on folio 361, which records orders placed on Tuesday 23rd April 1929. Some Measure Book entries cannot be found at all in this Day Book, raising the possibility that other account books from the firm have been lost.

The entry here states that the order is for Captain J.W. Turner of 6 North Road, and is for 6 Angola flannel tennis shirts to order, at 16 shillings 6 pence each. The total sum of £4-19-0 is repeated in another column marked 'R', which presumably stands for 'Received'. The reference B-125 is given at the side. This is a cross-reference to the folio in the relevant Sales Ledger.

Sales Ledger of R. and F.E. Lamb Ltd. (Lb A 18)

View larger version

Only one Sales Ledger from R. and F.E. Lamb Ltd. has survived (Lb A 18), but it is clear from internal evidence that there were others which have now been lost. This Ledger is marked 'B', but most of the accounts follow on from entries in Ledger A, and continue to Ledger C. The business clearly had a number of very loyal customers who placed many orders over the course of a number of years. Odd orders from customers not previously known to R. and F.E. Lamb are noted in a separate sequence at the back of the volume.

Captain Turner's account can be found, as expected, on folio 125. At the top of the page are his personal details: Captain J.W. Turner, M.C., of the 2nd Sherwood Foresters, and of The Cottage, Barrow, Derby.

Among the many orders that Captain Turner placed with R. and F.E. Lamb is the one of 23 April 1929. The order is noted on the Debit side of his account, because he has received the stock from the company and is therefore indebted to them. It reads 'To Angola fl. tennis shirts to or[der]', provides the reference 361 [which refers back to the Sales Day Book], and gives the price, £4-19-0.

The Credit side of his account records the various payments Captain Turner made to clear his debts with the company - thereby putting him in credit with R. and F.E. Lamb. The £4-19-0 for the tennis shirts was settled as part of a larger payment on 6 July 1929. The ledger reads, 'By cash and dis[count] 10/6, £21-0-4'. The reference 127 appears next to this entry, referring on to the Cash Book

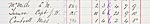

Cash Book of R. and F.E. Lamb Ltd. (Lb A 21)

View larger version

The Cash Book (Lb A 21) records the flow of money in and out of the company's account. It is arranged in date order.

On the left hand pages are the entries for the Receipts account (Dr.). On folio 127 we find an entry dated 6 July 1929, for 'Turner, Capt. J.W.' In the column marked 'Discount' we see '10/6', and in the column marked 'Sales Ledger A/Cs' we see '£20-9-10'. The reference 125 appears next to this entry, referring back to the Sales Ledger. This debit entry balances the credit entry in the Sales Ledger, the £20-9-10 being the actual amount paid after the discount of 10 shillings 6 pence was applied. Other columns for this account are 'Cash Sales and Sundries', in which receipts paid by cash at the time, rather than on credit, are recorded; and 'Paid to Bank', representing the deposit of all these receipts into R. and F.E. Lamb's bank account.

On the right hand pages are the entries for the Payments account (Cr.). The Payments account records money paid out by R. and F.E. Lamb. There are columns for 'Discounts', 'Bought Ledger A/C', 'Cash Purchases and Trade Expenses', and 'Paid by Cheque'. Entries here would balance entries in the Purchase Ledgers (Lb A 19-20).

Next page: Tax Records