Cash Substitutes

The only true form of 'ready-money' cash is a coin, although nowadays even coins are not really worth the money they represent.

A British pound (£) used to be literally worth its weight in silver (a pound of silver is around 454 grams in metric weight). In the early nineteenth century Britain adopted the 'gold standard', which linked the worth of a £ to its weight in gold. The gold standard was abandoned in 1931. Nowadays, exchange rates and monetary values are not fixed. Therefore, the value of the 10 pence coin in our wallet fluctuates along with the value of the £.

We also use bank notes, which are a paper substitute for the amount of cash they represent. If we have a bank account, we also use cheques to transfer money to somebody else. Both bank notes and cheques have long histories in Britain. They are sometimes known as 'negotiable instruments'.

All of these methods of payment are likely to be superseded in the next few years by electronic banking.

Banks

In brief, British banks evolved from goldsmiths, who began in the seventeenth century to store precious metals, jewels and coins for their customers, and to lend money on that security. The Bank of England was established in 1694. By the nineteenth century there were a wide variety of banks in existence, including private banks, joint-stock banks, country (local) banks and the national banks of England and Scotland. Each bank could issue its own notes.

The Drury-Lowe collection at the University of Nottingham includes a 1774 account book of the London banking business of Messrs Raymond, Vere, Lowe and Fletcher. The account book (Dr A 6) is a record of the business of the bank in 1774. Withdrawals and deposits made by the bank's customers are listed. Customers included Lord James Manners, and the Shadwell Water Works. There were £338,156 16s 8d worth of deposits. At the end of the book is a balance sheet, settled up to 24 December 1774, showing debts and payments on the left hand side, and stock and receipts on the right hand side. The total of the account was £380,678 10s 7d.

The partners Messrs Raymond, Vere, Lowe and Fletcher became founder shareholders of the London and Manchester Bank. This bank, in common with many other small banks, ended up being amalgamated into larger concerns. The London and Manchester Bank became part of Williams, Deacons & Co., then part of Williams and Glyn's Bank, and ultimately part of the Royal Bank of Scotland. To discover where records of old banks have been deposited, see John Orbell and Alison Turton, British banking : a guide to historical records (Aldershot : Ashgate, 2001) [King's Meadow Campus (MSS) Ref HG1616.R4].

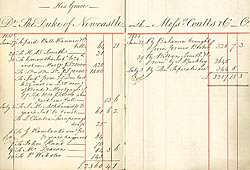

Bank book, 1838-1843 (Ne A 807)

View larger version

Other archive collections include banking records kept by the customers themselves. This example of a mid-nineteenth century bank pass book belonged to the 4th Duke of Newcastle and records his transactions with the bankers Messrs Coutts & Co. The money paid out of the duke's account is listed on the left hand page, under 'Dr'; the money paid in is listed on the right hand page, under 'Cr'.

The account was principally used to fund regular payments such as annuities to family members, interest on loans and portions, insurance payments, and subscriptions to institutions such as the Athenaeum Club, Boodles, and the Royal Academy of Music.

Promissory notes and bank notes

A promissory note is a written promise by one person to pay money to another. In the eighteenth and nineteenth centuries there were two main forms of promissory note:

- Notes payable to a named person, on or after a specific date

- Notes payable to the bearer, 'on demand'

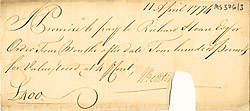

Promissory note, 1774 (MS 376/3)

View larger version

An example of the first type of note is shown here. It is signed by J. Bentinck, dated 11 April 1774, and reads 'I Promise to pay to Richard Hoare Esq. or Order Four Months after date Four hundred Pounds for Value rece[ive]d, at 4 p[er] Cent. J. Bentinck.'

Because it mentions interest of 4 percent, it is clear that it is a promissory note for paying back a sum of money received on loan. The note is made out to Richard Hoare 'or Order', meaning that the money could be received by another person nominated by him. If Richard Hoare did wish the money to be paid to his order, that is to someone else, he would write instructions to that effect on the note in an endorsement.

The second form of promissory note is the form that survives today as a bank note. The money mentioned in the note is payable to the bearer (whoever is in possession of the note), 'on demand' (whenever the bearer requests payment). This type of note was legalised in 1704 by the Promissory Notes Act.

Robert Goodacre, master of Standard Hill Academy in Nottingham, in his book A Treatise on Book-Keeping adapted to the use of Schools, published in 1818 [King's Meadow Campus Briggs Collection LT210.HF/G6, p.248], explained such notes as follows:

Promissory Notes payable on demand may be reissued after payment. Indeed the Bank Notes in common use, which are always of this description, are frequently paid and repaid till the paper on which they are drawn is literally worn out.

Most promissory notes in this form were issued by the banks. In the mid-seventeenth century goldsmiths began to issue receipts to their customers for money deposited with them. These developed into bank notes. If the notes did not specify the name of the person to be paid, they did not have to be endorsed in order to be passed on to anyone else. They began to circulate between a variety of different people. They were a representation of actual money (gold or coins) that you could access by going to the bank and presenting the note as a bearer. They therefore began to be used as a means of exchanging money for goods and services.

At first, bank notes were handwritten and could be made out for any sum of money. Later on, standard notes were produced for particular amounts, for instance £5. Bank of England bank notes were part-printed after 1745, and wholly printed after 1855. Other English and Welsh banks also issued bank notes, but this was phased out over the course of the late 19th century. The last note by a commercial bank was issued in 1921.

Today's bank note is a promissory note payable on demand, with almost exactly the same wording as would have appeared two hundred years ago:

I promise to pay the bearer on demand the sum of twenty pounds. [signed] London, for the Governor and Company of the Bank of England, Andrew Bailey, Chief Cashier

Bills of exchange and cheques

Both of these financial instruments are instructions by one person for payment of money to another person. The money was actually paid by a third party (usually a bank).

The fore-runner to the modern cheque was the bill of exchange, originally a private transaction involving a money-lender. It was described by Robert Goodacre in A Treatise on Book-Keeping adapted to the use of Schools, published in 1818, as follows:

A bill of exchangewritten order drawn by one person A, on another person B, directing B to pay, on his account, a certain sum of money, therein specified, according to the direction of a third person, C.

The person ordering the exchange (A) was known as the 'drawer'. The person receiving the order (B) - the third party - was called the 'drawee'. The drawee would already have money on deposit from the drawer, or would be confident that the money would be repaid to him. Bills were usually endorsed (written on) by the drawee to indicate his acceptance of the bill.

(C) was the 'payee', although this did not mean that he would always be paid the money in person. The payee 'directed' the payment of the money, meaning that it could either be paid to him, or he could order it to be paid to somebody else - for instance, in part-payment of one of his own debts. In such a case, the bill was endorsed by the payee with details of to whom the money should be paid, and transferred to that person.

Bills of exchange were usually payable at a particular point in the future, as specified. The person ultimately receiving the money was obliged to go in person to the drawer on the day the bill became due, to demand payment in cash. Legal processes were in place to deal with cases where the drawer refused to pay.

Bill of exchange, 1843 (Pl F8/8/14/29)

View larger version: page 1, page 2

Bills of exchange were normally used for large amounts of money, or for transferring money overseas. This example from 1843 is a bill of exchange from Colonel Joseph de Hezeta of Seville, Spain. He is the drawer. The payee is Mr. H. Backhoffner 'or order' (that is, anyone nominated by Mr Backhoffner). The drawee is Charles Heaton Ellis of Great Mortimer Street, Cavendish Square, London. The order reads:

Seville September 18 1843.

Three days after sight of this my first of exchange pay to Mr. H. Backhoffner or order the sum of six pounds sterling value received and place the same to the debt of m/a [my account] as the advice of this date.

[Signed] Joseph de Hezeta

[To] C. Heaton Ellis Esq

Great Mortimer St

Cavendish Sa

On the same day, the bill was endosed by Mr Backhoffner, 'Please to pay to Dr. G.H. Backhoffner the sum of £6'. The bill would then have been sent to Dr. G.H. Backhoffner and presented by him to Charles Heaton Ellis in London. Three days after Heaton Ellis saw the bill, he would have paid Dr. Backhoffner the £6 in cash. The money still needed to be paid back to Heaton Ellis by Colonel de Hezeta at some point. In the meantime, his debt was noted by Heaton Ellis.

This bill of exchange was payable after sight. Others were payable after a certain specified date. Bills could also be payable on demand, that is, with no prior warning given to the drawer. Robert Goodacre gives the following example:

'On demand pay to Mr. James Matthews or bearer, ninety-six pounds nineteen shillings and sixpence, value received, and place the same to the account of JOHN JAMES'

This means that John James is authorising the drawer to make an immediate cash payment of £96-19-6 either to James Matthews, or to the person bringing the bill to be cashed. Goodacre goes on to say,

'Bills payable on demand or at sight differ from those already described [i.e. bills payable after sight or after a certain date], not only in the time of payment, but also in their seldom being transferred, either by endorsement or otherwise. They are generally drawn by persons having Cash in Banks, and … they are immediately presented to the drawers, as Orders or Checks for the payment of the sum therein expressed. When they are issued under these circumstances, they are generally termed Bankers' Checks.'

It is easy to see that bills of exchange payable on demand evolved into modern-day cheques (still spelled 'check' in America).

Cheque book, 1809 (Ne A 837)

View larger version

This is an example of an early printed cheque book issued by Messrs Thomas Coutts & Co. Space is left for the cheque book owner to make out the cheques to a named payee, or to the bearer. Counterfoils of completed cheques can be seen at the left hand side, made out in May and June 1809. The cheque book comes from the Newcastle collection, and may therefore have belonged to Henry P.F. Pelham-Clinton, 4th Duke of Newcastle.

Next page: Household and Estate Accounts